IOI’s Palm Oil Dashboard was launched online in December 2016. The Palm Oil Dashboard presents key information relating to our operations and suppliers. Furthermore, maps of our refineries and mills, as well as the latest news and relevant links are also available on the Palm Oil Dashboard.

192,560 HA RSPO CERTIFIED

168,797 HA MSPO CERTIFIED

4.31 MT/ Ha

(Industry Average = 3.14 MT)

Pukin Palm Oil Mill

Gomali Palm Oil Mill

Bukit Leelau Palm Oil Mill

Pamol Kluang Palm Oil Mill

Sabah

Pamol Sabah Mill

Syarimo Mill

Sakilan Mill

Baturong Mill

Leepang Mill

Ladang Sabah Mill

Mayvin Mill

Morisem Mill

Unico Desa Mill

Indonesia

PT Sukses Karya

Sawit Mill

94 DIRECT SOURCING

232 INDIRECT SOURCING

LATEST NEWS

ORIGIN OF OUR OIL

ORIGIN OF SOURCES

Direct & Indirect Sourcing

As of December 2023

Sourcing Regions

Origin of FFB Linked to IOI Refineries

As of December 2023

Origin of IOI Mills' FFB Supply

External supplier refers to third party plantations, dealers and smallholders.

As of December 2023

Origin of Supplier Mills' FFB Supply

External supplier refers to third party plantations, dealers and smallholders.

As of December 2023

CERTIFIED VOLUMES SOURCED(MARKET DRIVEN)

Palm Oil

IOI Group Total

Palm Kernel Oil

IOI Group Total

TRACEABILITY TO PLANTATION

Palm Oil

Palm Kernel Oil

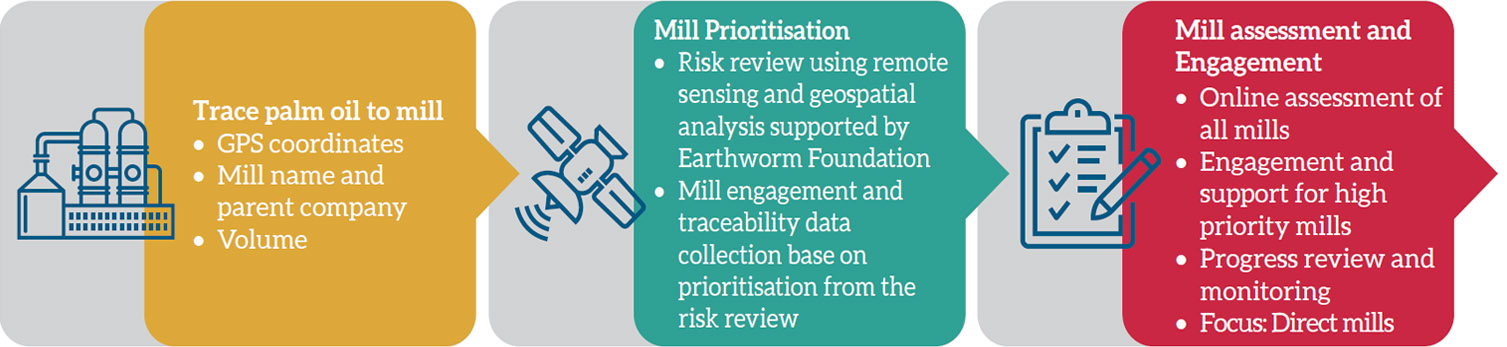

Mills Assessment on NDPE Compliance

Mill Assessment 2023

Mill Prioritisation Profile (*2024)

i. Traceability To Plantation (TTP)

TTP score of 100% is targeted for each supplier. As such, priority in engagement is given to suppliers with scores of less than 100% or no TTP data provided, with the aim to improve their scoring.

ii. Deforestation threat level

Spatial data related to all suppliers are collected and the land use changes are analysed to prioritise the suppliers based on the risk rating. The tools and services involved are Global Forest Watch Pro and Palmoil.io - MapHubs web application, in addition to satellite monitoring service by Starling - Earthworm Foundation and deforestation alert reports from multiple sources.

iii. History of supplier engagement activities

Suppliers are engaged via activities such as gap assessments, briefings and workshops to improve their NDPE compliance, with each engagement focusing on a specific topic to address the identified gaps.

iv. Status of action plans from supplier assessment

All suppliers are required to complete a self-assessment on NDPE compliance. The assessment tool (Tools for Transformation - T4T) helps to identify gaps in implementation and generates appropriate action plans. Subsequent engagement activities are planned based on the assessment results.

v. Amount of supply volume

Engagement plans are determined by the supply volume by suppliers. High volume suppliers are generally prioritised over low volume suppliers. However, engagement priority is also given to low volume suppliers who require support for improvement.

Based on these aspects, the suppliers can be categorised as high, medium or low priority mill. The prioritisation aims to direct our engagement efforts to the most appropriate group of suppliers. Suppliers in the high priority mill category are not the equivalent of high-risks suppliers, instead it signifies that there is room for improvement.

Palm Oil Traceability

Tracing the origins of our oil allows us to monitor and engage with our suppliers to ensure a more transparent and sustainable supply chain. IOI’s three-step palm oil verification approach requires that all mills and refineries in the supply chain disclose information such as GPS coordinates and ownership groups.

Engagement with Suppliers

IOI engages with new suppliers through a Pre-Qualification and screening process as articulated here to ensure the new suppliers meet IOI’s sustainability requirements. New suppliers are screened using social and environmental criteria to meet the essential NDPE commitments. IOI will not approve any new suppliers that are unable to commit to these requirements.

For existing suppliers, IOI has implemented and communicated a proactive mill-level programme. This programme supports the supplier companies to adopt sustainable practices that adhere to IOI’s SPOP commitments whilst providing guidance and resources towards the adoption of sustainability best practices.

Non-compliance with IOI’s SPOP will trigger engagement and if required, corrective action plans and re-evaluation of commercial relationships for repeated failures.

*IOI is using Starling Satellite Services to monitor our supply base for land use changes and deforestation.

Click on the links below to view our engagement with suppliers: -

Update on Aidenvironment / Earth Equaliser monitoring 30 April 2020 / 15 May 2020

Supplier NDPE T4T Progress Update No.2

NDPE and Responsible Production with IOI Mills and Estates

Engagement with Tanah Emas Mill

Supplier NDPE T4T Progress Update No.1